Scaling internationally is an exciting way to grow an eCommerce brand, but it can also be challenging. One of the hardest parts? Managing duties and taxes. Calculations depend on a lot of factors, like where you’re selling and the specific products you’re selling. Rules can change overnight, and getting it wrong means losing money — or worse, losing customers.

With new tariffs making headlines and international regulations shifting constantly, duties and taxes are more confusing than ever. A 10% tariff is being applied to all imports into the US, up to a 245% tariff on goods from China, a 25% tariff on all steel and aluminum imports into the US, and a 25% tariff on imported vehicles and auto parts. When even the experts are having a hard time keeping up with all the changes, how can an eCommerce manager stay on top of it all?

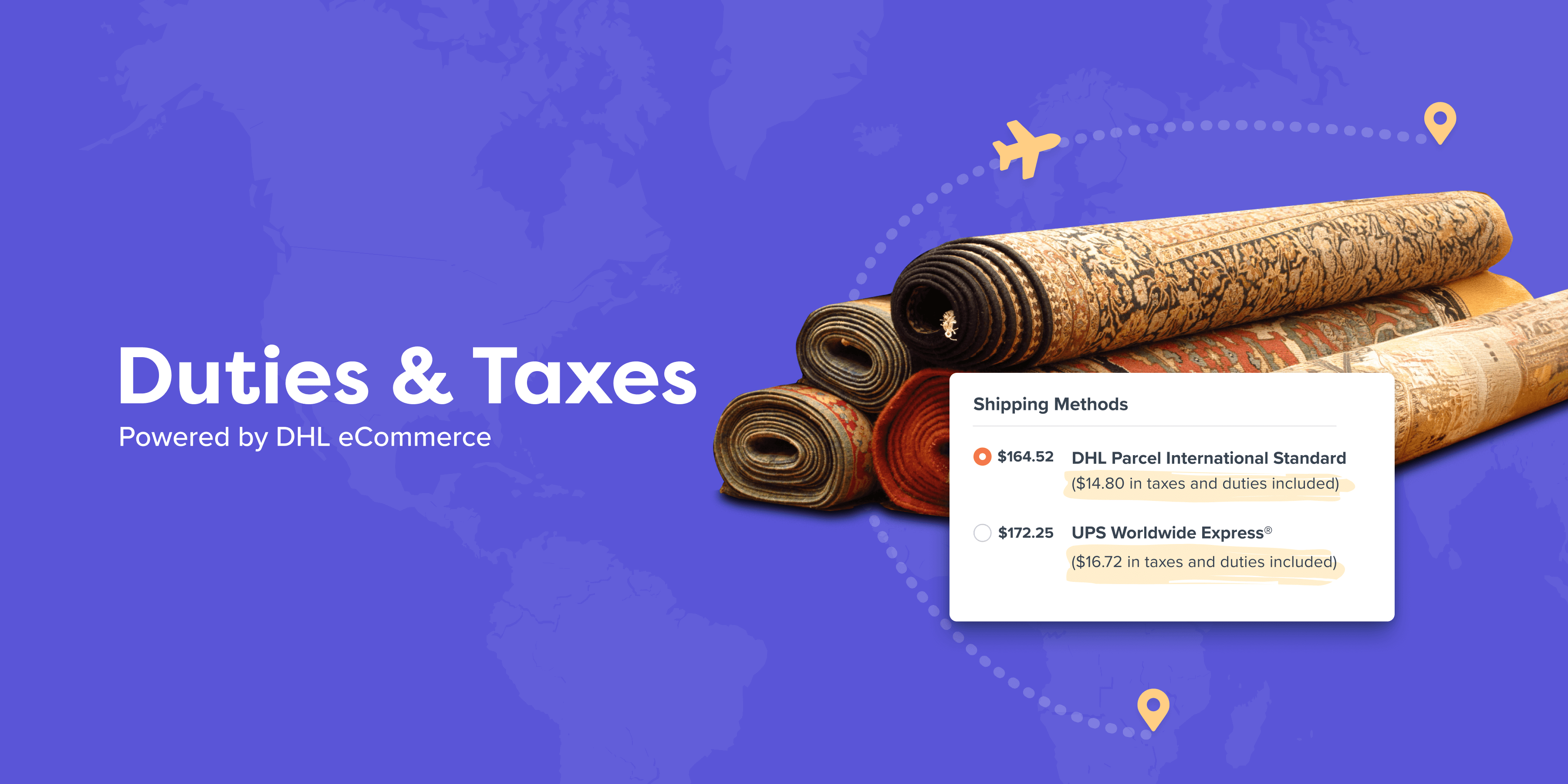

Introducing ShipperHQ’s New Duties and Taxes Feature Powered by DHL eCommerce

We set out to simplify duties and taxes well before tariffs entered the headlines, and now that mission is more urgent than ever.

Meet ShipperHQ’s new Duties & Taxes feature. Powered by DHL eCommerce, our new feature is your best defense against unpredictable tariffs. It lets you automatically calculate and collect duties and taxes at checkout to give your customers exactly what they want: a smooth, transparent experience from purchase to delivery. With real-time updates powered by DHL eCommerce, the rates shown at checkout will always reflect the latest tariff updates, so neither you or your customers get caught off-guard.

Here’s How It Helps You Simplify Global eCommerce

Even before the latest tariffs, global eCommerce wasn’t easy. Over the past year, our team has talked with hundreds of merchants and heard a lot of stories about having to manually calculate duties and taxes across hundreds of markets and product SKUs, getting hit with surprise fees and costly returns, and dealing with unhappy customers who never received their packages. Not fun.

Now imagine being able to automate all that complexity with accurate duty and tax calculations at checkout, transparent pricing to your customers, and fewer customer support inquiries. That’s what you can do with our Duties and Taxes feature. No more scrambling every time a tariff or regulation changes, no more manual guesswork, and no more unhappy customers getting slapped with surprise fees after they’ve already paid. Just accurate pricing and a seamless customer experience, every time.

What Makes this Duties and Taxes Feature Stand Out

ShipperHQ’s Duties and Taxes feature goes beyond basic calculations. Here’s what makes it so powerful:

Powered by DHL eCommerce, Works with Any Carrier

The duty and tax calculations are powered by DHL eCommerce, but you can use any carrier you want—UPS, USPS, FedEx, or your favorite international carrier. You’re covered for all international carriers across 200+ countries.

Real-Time Pricing Updates

The feature pulls duties and taxes data from DHL eCommerce, which always has the latest data and updates in real-time. With this feature, your checkout always reflects the latest tariff or tax change the moment it kicks in. No manual updating, just seamless compliance.

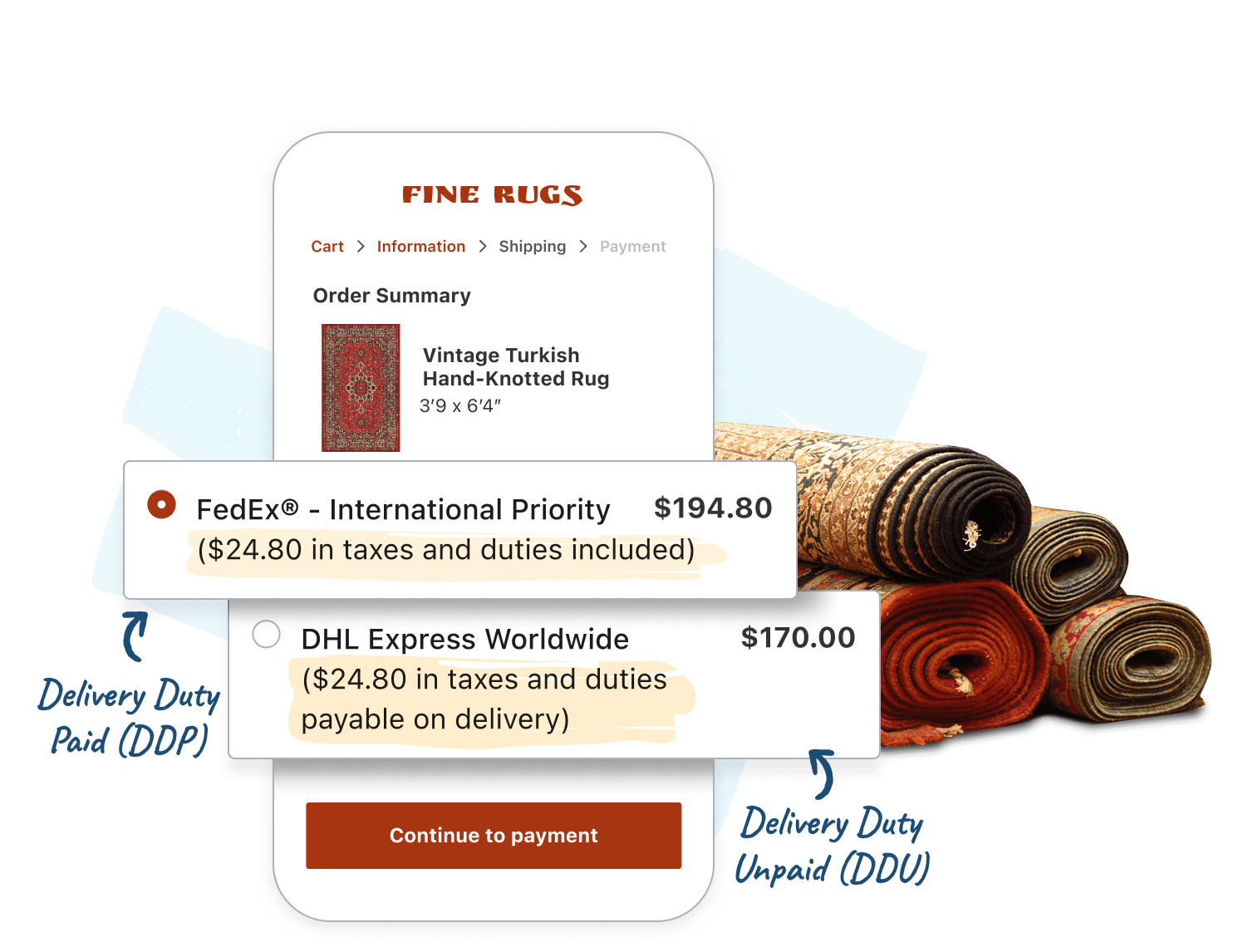

Transparent Pricing You Can Control

Customers see what they owe upfront before they hit ‘place order.’ Not after. This means fewer abandoned carts, fewer returned packages, and way more trust. Choose between Delivery Duty Paid (DDP) and Delivery Duty Unpaid (DDU), and even customize whether you display the minimum, maximum, or average charge when multiple values are available.

Preview How Duties and Taxes Perform in Your Checkout Before They Go Live

You can use ShipperHQ’s Test Your Rates feature to preview duty and tax calculations before they’re live. Once you’re up and running, you can track your duty and tax estimates through ShipperHQ Analytics.

Built to Scale

From established global brands to those just getting started in international sales, ShipperHQ grows with you. Customize the feature to fit your business model and add countries, carriers, or HS codes at your own pace.

Request Early Access to ShipperHQ’s Duties and Taxes Feature

Whether you’re already selling internationally or considering new markets, ShipperHQ can help. Our new Duties & Taxes feature simplifies global commerce, turning complex manual tasks into something you can set and forget. Your customers will thank you, your checkout flow will run smoother, and your business can keep scaling, no matter what happens with international tariffs.

Want to check it out? Request a demo and see firsthand how ShipperHQ’s Duties & Taxes feature can help you simplify international shipping without losing money (or your sanity).