Shipping orders across borders used to be a job only big brands could handle. Today, even smaller online stores see shoppers clicking in from various parts of the world. The catch is the extra fees, changing customs rules, and delivery promises that can slip. If you don’t keep an eye on those details, your profit on each order can disappear fast.

In this article, we’ll discuss every hidden international shipping cost in plain language. You’ll also discover easy-to-use tools, smarter carrier choices, and checkout tips that keep customers happy. By the end, you’ll have a clear playbook for shipping globally without draining your margin.

TLDR-

Ecommerce international shipping can shrink your profits fast. Hidden fees like fuel surcharges, DIM weight, and import duties – stack up quickly and when customers see unexpected costs at checkout, it can drive up your cart abandonment rates. Map every SKU to the correct HS code, run a landed-cost calculator before you publish rates, and audit invoices each week so you always know the real door-to-door cost.

Track success with four core KPIs: landed-cost accuracy, cart-to-order conversion, on-time delivery, and customs-inspection rate. Keep an eye on tightening tax rules, greener carrier lanes, and AI-driven carrier selection – each trend can push your shipping costs down even further. Most important of all, show duties and taxes upfront at checkout. When buyers see the full landed cost at checkout, cross-border orders feel just as easy as domestic ones, and your store wins the sale.

Why Is International eCommerce Shipping So Expensive?

International eCommerce is a game of handling hidden expenses. Knowing every layer of the cost stack is step one to keeping more cash in your pocket.

What Costs Make Up eCommerce Shipping Fees?

Here’s where the money really flows on an international label.

- Freight Rate – the sticker price you see on carrier sites.

- Dimensional Weight (DIM) – large but light boxes get charged like they’re heavy.

- Fuel & Peak Fees – adjust weekly and spike during holidays.

- Customs Brokerage – the fee for someone who files your papers.

- Duties & Taxes – set by each country’s rules.

- Last-Mile Extras – remote area, address change, or residential drop-offs.

How Hidden Cross Border Shipping Surcharges Hurt Margins

Surcharges rarely appear until the invoice lands after the parcel ships. Because they’re applied as percentages, higher-value orders take the biggest hit. The solution is a weekly invoice audit and automated alerts inside your shipping software so you can spot problem lanes before labels print.

Calculating Standard Shipping Rates for an Online Store

Before you publish rates at checkout, you need a clear view of landed cost – the full end-to-end expense.

Tools to Estimate eCommerce Shipping Costs

Accurate landed-cost calculators pull real-time carrier data and harmonized system (HS) codes to forecast duties and taxes. Popular options include:

- Carrier APIs (UPS, DHL, USPS) – ideal for single-carrier stores.

- Multi carrier shipping solutions– aggregate rates from dozens of carriers, including postal networks.

- Landed-cost engines – layer duties and taxes on top of transport fees for full visibility.

By feeding weight, dimensions, and destination into these tools, you’ll see the delivered cost before you publish rates in checkout.

Should I Use Flat, Table, or Real-Time Rates?

- Flat Rates – Simple and predictable, but risky for heavy or oddly shaped products.

- Table Rates – Tiered by zone and weight, offering a controlled balance.

- Real-Time Rates – Pulled live at checkout, protecting margin during fuel-price swings and peak season spikes.

Cross Border Shipping Best Practices to Reduce Duties and Delays

Cutting fees is only half the battle – you also need to keep parcels moving through customs.

HS Codes and Accurate Paperwork Save Money

Every SKU must map to a six-digit HS code. Misclassification triggers customs holds, fines, or both. Best practices include:

- Maintaining a centralized HS database and reviewing it quarterly.

- Printing commercial invoices electronically (ETD) to shave 1–2 days off clearance.

- Declaring realistic product values – customs officers can spot undervaluation instantly.

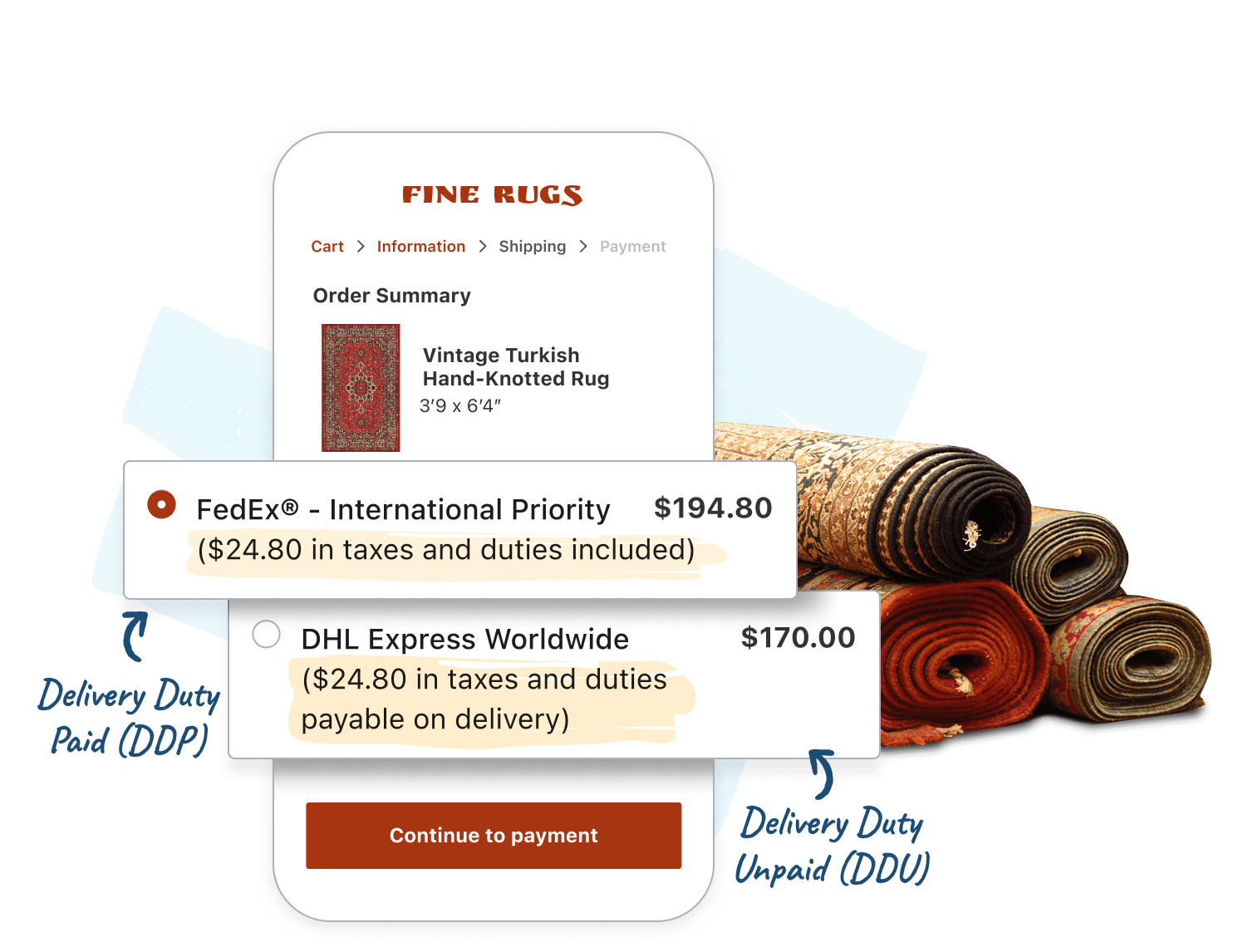

DDP vs DDU: Which Incoterm Protects My Margins?

Delivered Duty Paid (DDP) absorbs import fees for a friction-free customer experience. Delivered Duty Unpaid (DDU) shifts those fees to the buyer but risks refusals.

Many merchants mix both: DDP for low-value orders to maximize conversion, DDU for high-value items to hedge against steep tariffs.

Which eCommerce International Shipping Solutions Save the Most Money?

Having the right technology and smarter partnerships can cut costs when shipping internationally.

Multi-Carrier Rate Shopping Advantages

Rate-shopping software automatically pulls live quotes from postal, express, and regional carriers, then selects the most affordable service that still meets your promised transit time.

When to Outsource to a 3PL

If overseas volume becomes a daily routine or your key markets sit on different continents, a 3PL with bonded warehouses can stage inventory closer to buyers, shorten transit times, and bundle customs clearance to reduce per-parcel fees.

How Do I Launch International Shipping Without Losing Money?

A profitable launch starts long before you print the first label.

Pre-Launch Simulations for Profitability

- Basket modeling: Run your top SKUs through a landed-cost tool for each target country.

- Discount stress tests: Layer promotions onto that cost to spot margin killers.

- Transit-time audits: Compare promised delivery windows against carrier performance data.

KPIs to Validate Global Shipping Success

- Landed-Cost Accuracy – Check that the total you quoted (shipping + duties + taxes) matches the carrier invoice; keep variance below 3 % to guard your margin.

- International Cart-to-Order Conversion – Watch how many overseas shoppers who add to cart actually buy; rising numbers mean your rates and delivery promises feel fair.

- Delivery Time vs. Promise – Compare actual transit days to what you showed at checkout; hitting or beating the estimate builds trust and repeat sales.

- Customs Inspection Rate – Track the share of parcels flagged by border agents; a low, steady rate signals your HS codes and paperwork are on point.

Review these weekly for the first 90 days, then monthly once performance settles.

What eCommerce Shipping Trends Can Help Lower Costs?

The cross-border landscape is moving fast in 2025. By watching three big trend lines – regulation, technology, and sustainability – you can stay a step ahead of rising eCommerce shipping costs and even turn them into savings.

New Regulations Affecting International Shipping Fees

Governments worldwide are tightening low-value tax exemptions. For instance, the U.S. recently eliminated the de minimis exemption, which previously allowed low-value shipments (under $800) from China and Hong Kong to enter the US duty-free. This instantly increased duty exposure to many retailers. Staying aligned with trade news ensures you price products accurately and avoid unpleasant invoice surprises.

Sustainability Programs That Cut Shipping Costs

Carriers now offer discount incentives for carbon-neutral lanes and recycled packaging. Moreover, lightweight materials reduce dimensional weight, directly slashing eCommerce international shipping costs. Sustainability and savings can and should go hand-in-hand.

Tech-Enabled Efficiencies on the Horizon

With smart multi-carrier allocation, you can spread orders across the best-performing networks in real time, slashing delays and extra fees. Additionally, duty-paid micro-fulfillment hubs keep fast-moving stock inside key markets, shielding you from sudden tariffs and shaving days off delivery windows.

Calculate and Collect Duties & Taxes Upfront at Checkout

Nothing sours a sale like a surprise charge at the doorstep—show the full landed cost up front, and buyers stay happy to hit “Place Order.”

Why Up-Front Duties and Taxes Boost Conversions and Trust

21% of customers abandon their cart because they can’t see the total order cost upfront. Displaying the exact import charge at the checkout:

- Removes surprise COD bills that spark returns and charge-backs.

- Signals compliance and transparency, turning one-time buyers into repeat customers.

- Cuts customer-service tickets tied to “Where’s my package and why did my carrier ask for more money?”

How ShipperHQ’s Duties & Taxes Feature Makes It Easy

With ShipperHQ’s Duties & Taxes feature, you can:

- Calculate and collect duties and taxes for any of your international carriers, not just DHL, in over 200 countries

- Unlike other solutions that lock you into specific fulfillment providers with high transaction fees, our solution works with any carrier at a predictable price

- Customize your pricing strategy by choosing between Delivery Duty Paid (DDP) or Delivery Duty Unpaid (DDU)

- Always up to date, since it’s powered by the same deep expertise used by DHL itself

- Get started fast with no-code setup

Turning International Shipping into a Profitable Growth Engine

International shipping doesn’t have to be a gamble. When you understand every charge in the cost stack, lean on real-time rate shopping, and collect duties and taxes before the parcel leaves the warehouse, cross-border orders start looking a lot like domestic ones – predictable, transparent, and profitable.

The merchants winning today are the ones who treat shipping as part of the customer experience, not just a back-office expense.