One misstep with customs could lead to a disaster. What can you do to avoid this?

New tariffs are increasing the Cost of Goods Sold (COGS), especially for cross-border eCommerce brands. A 25% tariff on certain goods from Canada and Mexico, a 34% (over the 20% applied previously) tariff on products from China, and a 25% tariff on all steel, aluminum, and automotive imports are just the start. These changes directly impact your earnings, making it harder to maintain healthy margins and provide accurate, transparent shipping costs to customers.

If you’re selling globally, some of the most important questions you need to answer are:

How are these policy shifts impacting your costs and your pricing?

How do you ensure your products clear customs?

And how do you stay transparent with your customers about these added costs?

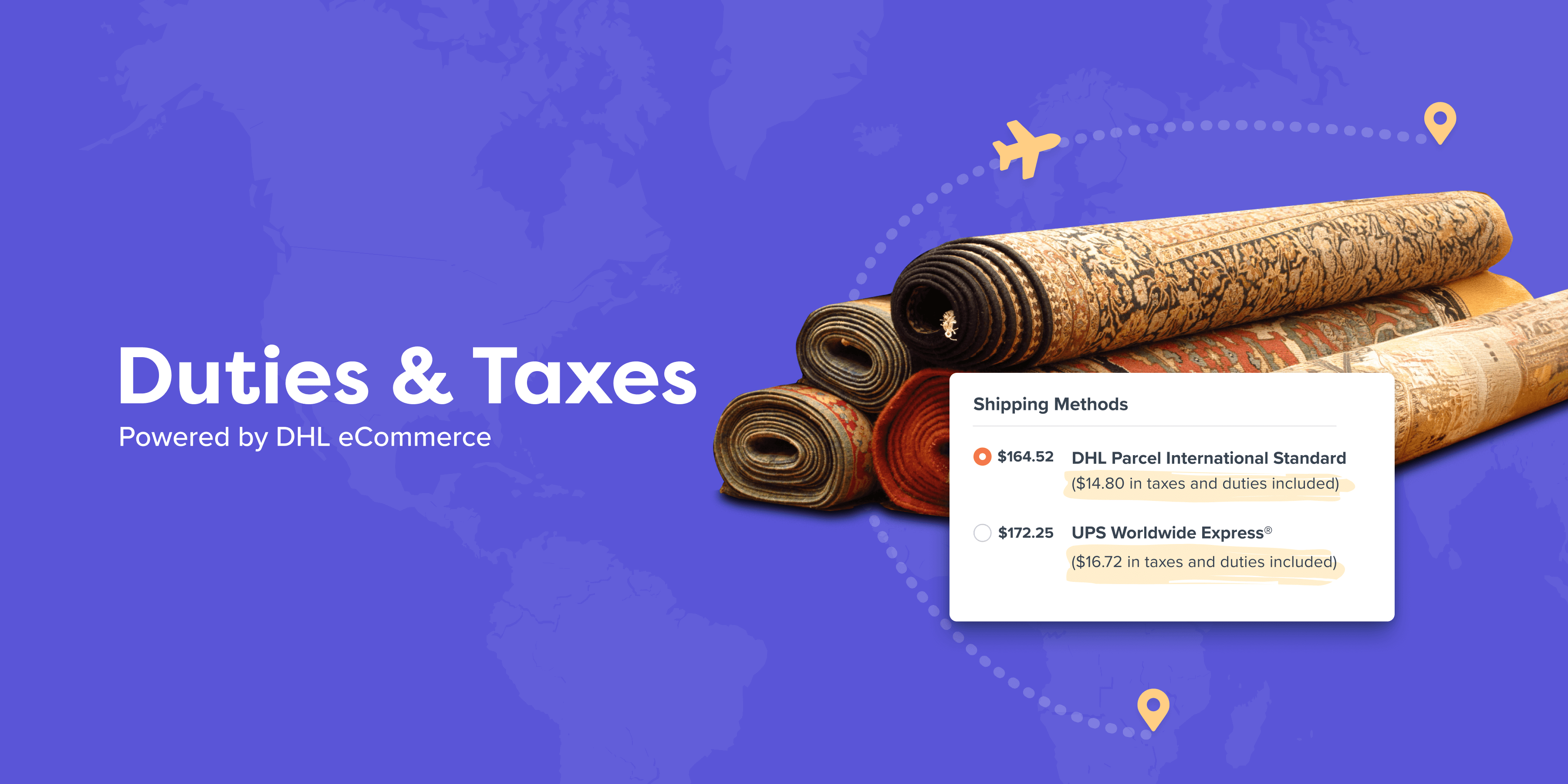

ShipperHQ’s new Duties & Taxes feature, powered by DHL eCommerce, can help you increase transparency and improve the customer experience. With this tool, you can automatically calculate and collect real-time duty and taxes at checkout.

Learn more about how ShipperHQ’s Duties & Taxes feature simplifies international eCommerce.

Look, cross-border shipping is a lot like baking. You’ve got to have the right tools, follow instructions, and do things in the correct order.

One error could lead to a big disaster.

If you’re unsure what a baking mishap looks like, you need to check out the Netflix series Nailed It!

In each episode, a group of three amateur bakers competes to recreate intricately decorated desserts. If you’ve ever tried to make a picture-perfect dessert from a Pinterest recipe, you know it’s rarely as easy as it looks.

Unfortunately for many stores, cross-border shipping is the eCommerce equivalent of a Pinterest fail.

In theory, it seems simple.

You already ship teacups, necklaces, or sweaters from one state to another. How much more different could it be to ship to another country?

- You get your first order from the U.K.

- Do a quick internet search

- Send your first order from Nashville to London

It’s that easy right? Well, you could have your customer’s order held up in customs for two weeks or more. Yikes.

What should you have done instead?

Today we’re helping you cook up a recipe to avoid a customs calamity.

We’ll examine what customs is, why it’s a hassle, and what you can do to prevent some of the most common problems.

How do customs work for packages?

Items must go through customs before authorities release them for final delivery when shipping from one country to another.

Does customs check every package?

The short answer is yes. Customs checks all inbound international packages and mail. During this process, a customs officer in the country you’re shipping to will review the package to make sure it meets the country’s laws, regulations and policies. They will also determine what duties and taxes might be due.

If you’ve traveled internationally, you went through customs when you landed. You probably filled out a form beforehand with questions ranging from basic to somewhat odd, like if you’re transporting soil or animal parts. Then you answered a few of the customs officers’ questions once you got off the plane. And before you know it, you’re on your way.

Customs for packages works similarly. You still must have a customs form. The main difference is you’re not with the package to answer any questions the customs officer has. And that’s where the problem lies for many novice cross-border shippers.

Quick clearance requires providing all the right information about your package before you ship it.

Do customs open every package to verify information?

No, customs officers will not open your package or packages without a good reason. They scan every package with a scanner or x-ray machine to verify that the items match your customs forms. However, they will immediately open a package if it is damaged, contains irregularities (i.e., does not match your declaration form), or if they select it for random checking.

How long do packages stay in customs on average?

Unfortunately, no cut-and-dry answer exists for how long packages stay in customs. This duration varies greatly from country to country and depends largely on what is being shipped. Customs may approve packages immediately, especially if the goods are not taxable. However, delays can occur if duties and taxes are still owed. Customs may also hold items if they are restricted and cannot enter the country.

Why is customs such a hassle for eCommerce shippers?

Customs can be quite a headache for new cross-border shippers. Last year, World Customs Organization (WCO) Secretary General Kunio Mikuriya said customs officers around the globe were struggling with a “tsunami of small packages” thanks to the growth of eCommerce.

Most customs systems were designed to handle bulk orders from wholesale importers. If you regularly ship three pallets of paper plates, you probably know what you’re doing and have your paperwork in order.

However, the rise of B2C eCommerce drastically changed the volume of packages moving through customs. The increase in cross-border shipping is driven largely by sellers and buyers who may lack extensive experience with customs.

So not only are customs officers dealing with a massive increase in the number of packages they’re processing, but many of those packages are also missing the vital documentation needed to do their job and keep shipments moving through the process.

At the same time, many countries are introducing new regulations to capitalize on the growing eCommerce market or, in some cases, to protect domestic industries from growing international eCommerce rivals.

These changes go beyond the recent U.S. tariffs. Around the world, countries are updating trade policies, imposing retaliatory duties, and redefining what qualifies as taxable, often with little warning. What this means for eCommerce sellers is clear: your cost of goods, duties owed, and final delivery timelines can all change overnight.

Manually keeping up isn’t realistic anymore. That’s why tools like ShipperHQ’s Duties & Taxes feature are becoming essential for merchants who want to expand internationally without sacrificing profit or customer trust.

When does a package get stuck in customs?

So, what can you do to make sure your package isn’t stuck in customs? The first step is understanding what customs officers are looking for and what can cause them to hold your package.

The most frequent reasons a package gets stuck in customs are:

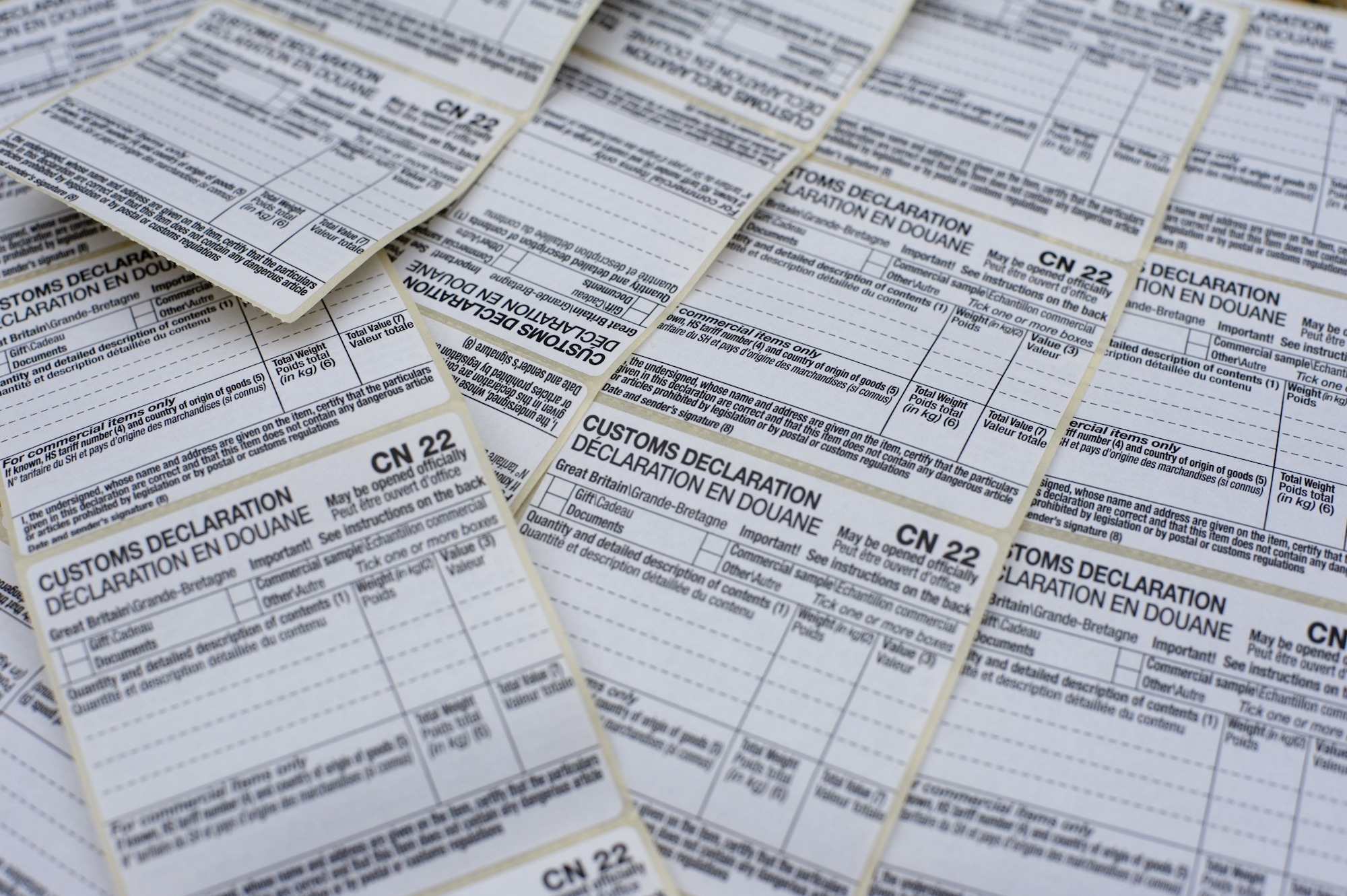

Missing Paperwork

Every international package will need a commercial invoice and a customs declaration form. The customs officer will use these forms to determine the value of the goods and what duties and taxes may be due. The commercial invoice should include details about the seller and the buyer, as well as more information about each item in the order:

- Unit Price

- Total Price

- Shipping cost charged to the customer

- Total Commercial Value

- Country of origin

- Item description and code from the Harmonized Commodity Description and Coding Systems

Note: Item codes can be tricky for new cross-border sellers. We recommend reaching out to your shipping carrier for help in making sure your inventory has the right HS code.

Having the correct paperwork isn’t just about making the customs officer’s job easier. Incorrect or missing paperwork could result in an officer tearing open your package to inspect it, or possible fines or criminal penalties.

Unpaid Duties or Taxes

Nothing is leaving customs if the appropriate duties and taxes aren’t paid. When shipping internationally, you have two choices. You can ship with the duties and taxes already paid (DDP) or unpaid, where the buyer has to pay them upon delivery (DDU).

For more on DDP vs DDU, check out our blog explaining both concepts. If you ship DDP and make a mistake in calculating the amount due, you will need to pay the balance before the carrier releases the package for final delivery. In this case, some carriers will bill you for the difference plus an additional fee for their efforts.

With ShipperHQ’s new Duties & Taxes feature, you can choose between a DDP or a DDU pricing strategy — the choice is yours.

Shipping Prohibited Items

A customs officer’s job is more than ensuring you pay taxes. They also ensure that prohibited items are not shipped into the country.

When shipping to a new country, it’s essential to learn about any specific regulations they have.

Here are a few examples from some of the top-growing eCommerce markets:

- China restricts imitation firearms and some types of communications devices, and cosmetics.

- The United Kingdom typically bans firearms and other weapons and has restrictions on meat and dairy from outside the European Union.

- Germany, like the UK, also restricts food products from non-EU member countries and places additional limits on some medical and dental supplies.

- France imposes restrictions on electronics, alcoholic beverages, and food from outside the EU. Additionally, France requires French language on all packaging.

- Canada places restrictions on pharmaceuticals, agricultural, food items, and some pet foods.

This isn’t an extensive list, but hopefully gives you an idea of what types of restrictions could exist in a country you’re considering shipping to. For more detailed information, be sure to check out Export.gov. You should also configure your eCommerce platform to prevent customers from purchasing items prohibited in the country they are shipping to.

What About Brexit?

As of December 31, 2020, the United Kingdom has officially withdrawn from the European Union. Following this withdrawal, the EU–UK Trade and Cooperation Agreement was proposed and currently allows for free trade of most goods with no tariffs or quotas. However, companies are still required to comply with customs regulations. They must pay customs fees and VAT (value-added tax), plus provide rules of origin paperwork to prove goods have been locally sourced.

Read more information about Brexit shipping changes

Conclusion

We hope you’re feeling confident enough to begin cross-border shipping. Remember to Nail it and not end up with a shipping fail, follow this simple recipe:

- Check the country-specific regulations for your product at export.gov

- Make sure your paperwork is in order, including information like harmonization codes

- Leverage a partner to take care of the heavy lifting of clearing customs

- Automatically calculate and collect duties and taxes at checkout to give your customers a seamless checkout experience.