Tariffs are government-imposed fees on imports, and they are on the rise in 2025. eCommerce merchants everywhere are feeling the strain of rising costs and uncertainty.

Understanding tariffs and their impact is important for making informed decisions about product pricing, the shipping and checkout experience, and customer communication.

Let’s discuss what’s happening with tariffs, how you can navigate this shift, and why transparency at checkout matters more than ever.

TLDR –

Tariffs are rising and making things trickier for eCommerce retailers. From sourcing to pricing, every step in the supply chain is feeling the pinch. To keep margins intact, many retailers are adding small, clearly explained surcharges at checkout.

But covering costs is only half the story – transparency matters just as much. Shoppers expect to see the total price upfront before they buy. When extra fees pop up later, it breaks trust. On the other hand, transparent pricing builds confidence and encourages repeat purchases.

The Latest News on Tariffs

It feels like tariffs are changing daily, but here’s where things currently stand:

Base Tariff: A general 10% tariff is in effect on US imports, raising costs across industries.

Steel and Aluminum: A 25% tariff on steel and aluminum imports will affect sectors like construction and manufacturing.

Automotive Industry: Imported vehicles and auto parts face a 25% tariff, influencing both production costs and retail pricing.

China Tariffs: As of April 2025, U.S. imports from China are subject to tariffs averaging 145%, though ongoing negotiations may lower that number. China has responded with its own 125% tariffs on U.S. goods.

Other Reciprocal Tariffs To Know:

Reciprocal tariffs were announced for 60 countries, but have been paused for 90 days until July 9 to allow for further discussions. A few of the countries impacted by reciprocal tariffs include:

- Vietnam: 46% tariff on all imports.

- India: 26% Tariff on textiles, electronics, and jewelry.

- Bangladesh: A 37% increase on apparel tariffs, pushing total duties above 50% for some items.

- Mexico & Canada: Goods compliant with USMCA would continue to enter tariff free, while non-compliant products would face a 25% tariff.

Changes to De Minimis Exemption:

Starting May 2, 2025, the U.S. removed the de minimis exemption for imports from China and Hong Kong. Previously, shipments under $800 entered duty-free. Now, they face either a 30% duty or a flat fee of $25 per item, increasing to $50 after June 1.

Tariffs are fluctuating right now, and it may take some time for things to settle. The brands that get ahead will be the ones that stay nimble, automate where it counts, and stay transparent with their customers.

How eCommerce Brands Can Adapt to Global Tariffs

Rising tariffs directly impact your production costs, supplier relationships, and even your marketing strategy. As the cost of goods sold (COGS) goes up, many retailers are left with two choices: eat the margin or pass those costs on to customers. That’s why we’re seeing more brands introducing tariff-related surcharges or fees at checkout.

And while staying compliant is critical, so is staying transparent.

Building Trust Through Transparency

Shoppers expect to see the full cost of their order upfront – duties, taxes, & shipping. When unexpected fees appear post-purchase, it erodes trust and often leads to returned packages.

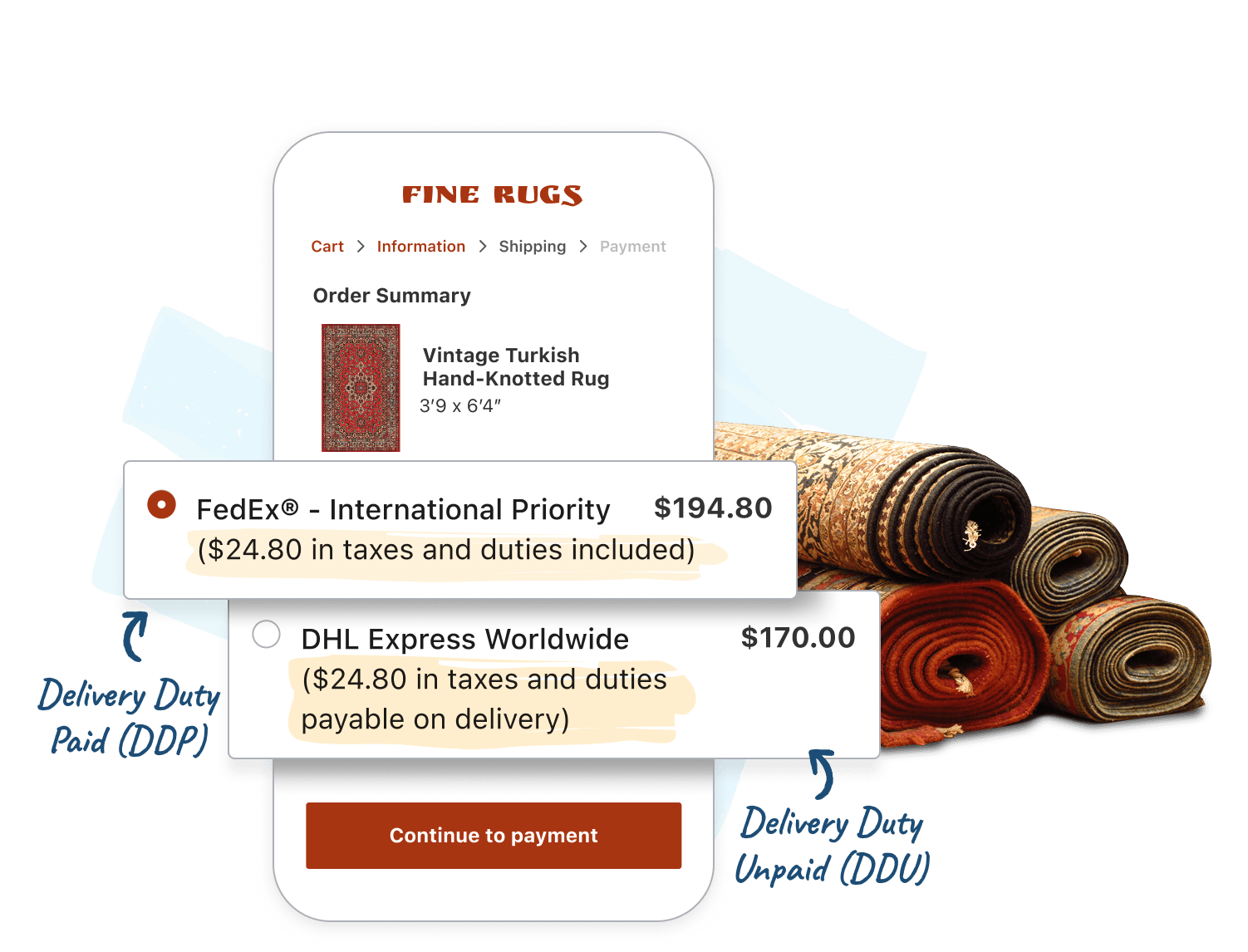

That’s why transparency at checkout isn’t optional. Customers want to know exactly what they owe before they hit “place order”. With options like Delivery Duty Paid (DDP) and Delivery Duty Unpaid (DDU), you can give them that clarity. DDP means that you cover all duties and taxes upfront for your customers, while DDU puts the responsibility on the buyer to pay upon delivery.

Automating Tariff Clarity

Even before these tariff changes, international eCommerce wasn’t easy. Hundreds of merchants struggle every day with manual duty and tax calculations, leading to surprise fees, costly returns, and unhappy customers.

Now, imagine automating all of that.

Keeping up with tariffs is tough. To help, we’ve launched a Duties & Taxes feature powered by DHL eCommerce. It automatically calculates duties and taxes at checkout and even lets you collect them upfront, add custom messaging, or add an optional tariff surcharge. Most importantly, it works with any global carrier.

If you want to succeed internationally, tariff and duty transparency at checkout is non-negotiable. The global tariff landscape is shifting, and you need to adapt to stay ahead. Get your checkout right, and you’re not just closing sales but building long-term loyalty.

Ready to simplify tariffs for your global customers? Learn how ShipperHQ can help you tackle tariffs.

See our Duties & Taxes feature in action!